The sub-4m SUV segment continues to dominate the Indian automotive market, registering impressive sales figures in April 2024. This segment, consisting of SUVs ranging from 3.8 to 4 meters in length, has witnessed significant growth, with total sales surpassing 1.09 lakh units. This marks a 22.35% increase compared to the same period last year, highlighting the rising popularity and demand for compact SUVs among Indian consumers.

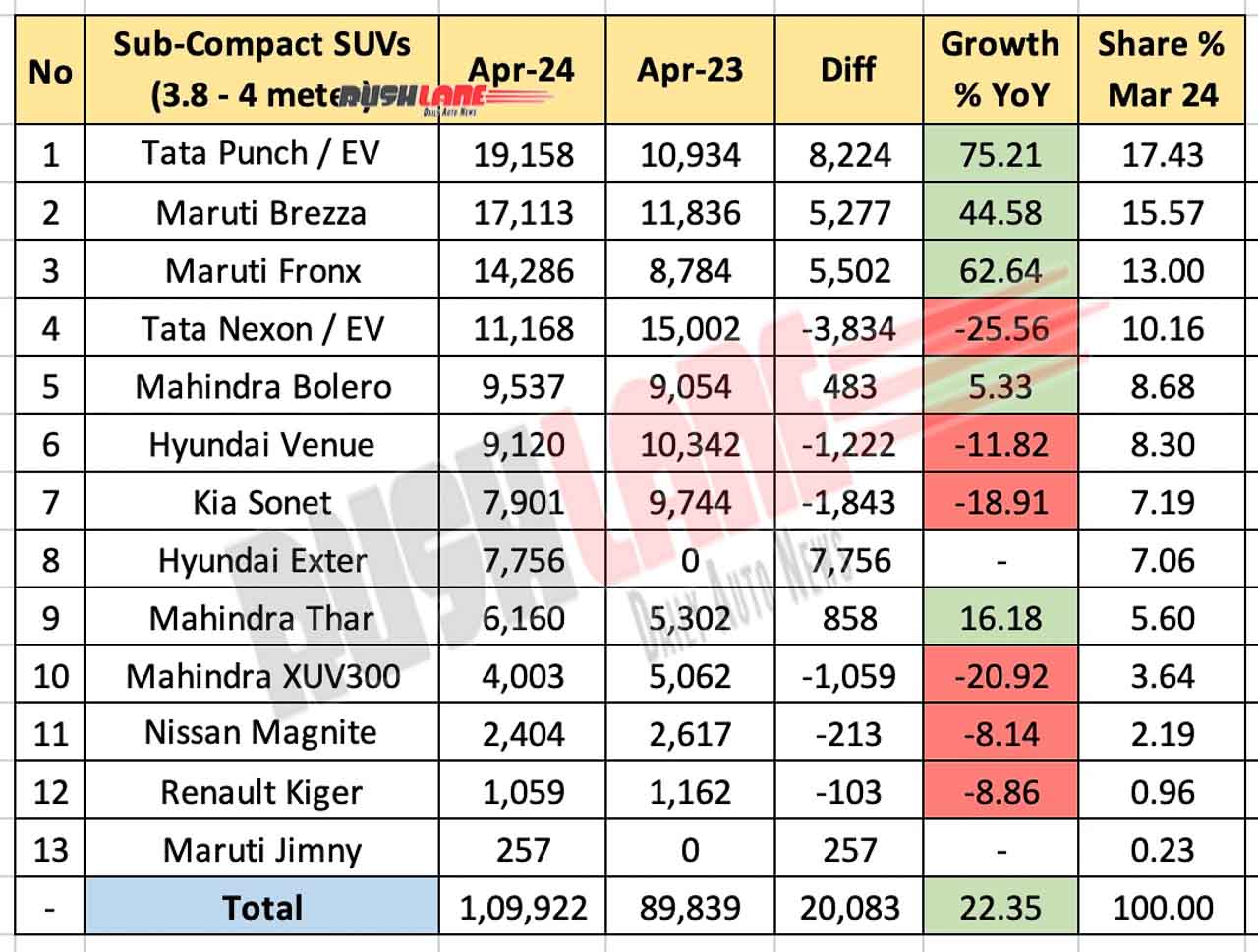

YoY Sales Performance: April 2024 vs April 2023

Leading the sub-4m SUV segment is the Tata Punch/EV, which has emerged as a formidable competitor. Over the past four months (January-April 2024), the Punch/EV has consistently outperformed its rivals, including the once-dominant Tata Nexon. In April 2024, the Punch/EV recorded a remarkable 75.21% year-on-year (YoY) growth, with sales soaring to 19,158 units from 10,934 units in April 2023. This impressive performance secured a 17.43% share in the sub-4m SUV market.

Following closely are two models from Maruti Suzuki: the Brezza and the Fronx. The Brezza sold 17,113 units, marking a 44.58% YoY growth, while the Fronx achieved 14,286 units, representing a 62.64% increase. These robust figures reflect Maruti Suzuki’s strong presence in the compact SUV segment.

In contrast, the Tata Nexon/EV, which previously led the segment, experienced a significant 25.56% decline in sales. The Nexon sold 11,168 units in April 2024, down from 15,002 units in April 2023, resulting in a volume de-growth of 3,834 units.

The Mahindra Bolero also performed well, with sales reaching 9,537 units, a 5.33% YoY growth. However, Hyundai Venue and Kia Sonet reported YoY declines, while the new Hyundai Exter entered the market with 7,756 units sold, securing the seventh position on the list.

Other notable performances include the Mahindra Thar, which recorded a 16.18% YoY growth with 6,160 units sold, and the XUV300, which saw a 20.92% decline to 4,003 units. The recently launched Mahindra XUV3XO is expected to boost future sales. Meanwhile, the Nissan Magnite (2,404 units) and Renault Kiger (1,059 units) faced declines, and the Maruti Jimny sold 257 units.

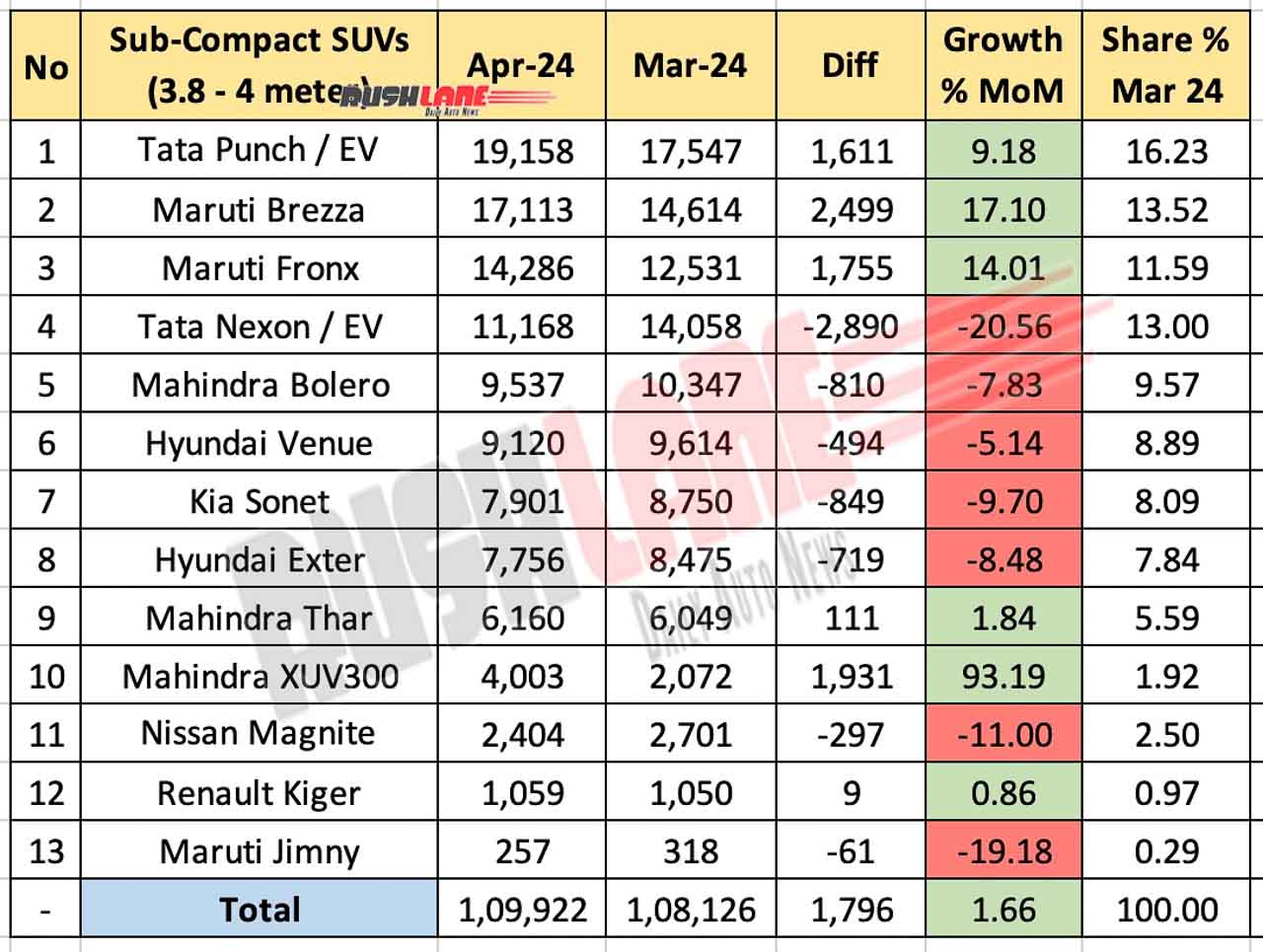

MoM Sales Performance: April 2024 vs March 2024

On a month-on-month (MoM) basis, the sub-4m SUV segment saw mixed results. The Tata Punch recorded a 9.18% increase in sales, up from 17,547 units in March 2024. Similarly, the Maruti Brezza and Fronx saw MoM sales growth of 17.10% and 14.01%, respectively.

Conversely, the Tata Nexon experienced a 20.56% decline in MoM sales. The Mahindra Bolero and Hyundai Venue also saw reduced sales, with declines of 7.83% and 5.14%, respectively. Kia Sonet and Hyundai Exter followed suit, with MoM sales decreasing by 9.70% and 8.48%, respectively.

However, the Mahindra Thar and XUV300 showed positive MoM trends, with sales increasing by 1.84% and a substantial 93.19%, respectively. Despite a challenging month, the Renault Kiger managed a marginal growth of 0.86%, while the Nissan Magnite faced an 11% decline. The Maruti Jimny trailed with a 19.18% MoM decline, selling 257 units in April 2024 compared to 318 units in March 2024.

The sub-4m SUV segment continues to thrive, driven by strong performances from models like the Tata Punch/EV, Maruti Brezza, and Fronx. Despite some YoY and MoM declines among other models, the overall growth of 22.35% YoY indicates a healthy demand for compact SUVs in India. With new launches and updates on the horizon, this segment is poised for further expansion and consumer interest in the coming months.